Dublin, July 02, 2024 (GLOBE NEWSWIRE) — “Global Enzymes Market by Product Type (Industrial Enzymes & Specialty Enzymes), Source (Microorganism, Plant & Animal), Type, Industrial Enzymes Application, Specialty Enzymes Application, Type of response and Region – Forecast to 2029” has been added to the report ResearchAndMarkets.com’s The offer of

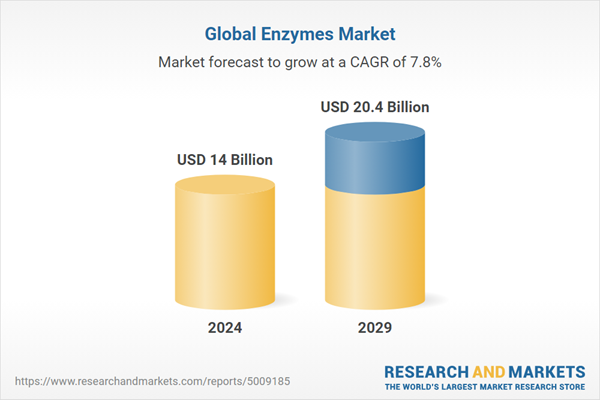

The global enzyme market is projected to reach USD 20.4 billion by 2029 from USD 14 billion by 2024, at a CAGR of 7.8%.

In the food and beverage sector, carbohydrates are essential for increasing product quality and process efficiency. For example, amylases are vital in the hydrolysis of starch during brewing and baking, while lactases facilitate the breakdown of lactose in dairy products for lactose-intolerant consumers.

Additionally, carbohydrases play an important role in biofuel production by converting biomass into fermentable sugars, supporting sustainable energy initiatives. In the animal feed industry, these enzymes improve nutrient absorption and digestion, optimizing feed efficiency and animal health. Their application extends to textile processing, where they help achieve desired fabric textures and finishes. The ability of carbohydrates to effectively address diverse industrial needs underscores their importance in driving innovation and economic growth within the enzyme market.

According to the source, microorganisms are estimated to dominate the market during the forecast period.

Microorganisms stand out as a widespread and versatile resource due to their ability to efficiently produce a wide range of enzymes. In the enzyme market is the production of proteases, a type of enzyme essential for various industrial applications such as detergent formulation, food processing and pharmaceutical production. Microorganisms, especially bacteria such as Bacillus and fungi such as Aspergillus, are abundant producers of proteases.

For example, Bacillus subtilis is known for its secretion of proteases suitable for detergent formulations due to its effectiveness in breaking down protein-based stains. Moreover, the advent of genetic engineering techniques has further increased the production of microbial enzymes. Through genetic manipulation, scientists can improve microbial strains to overproduce specific enzymes or modify enzyme properties to meet desired industrial requirements. This ability has significantly expanded the range and efficiency of microbial enzymes, reinforcing their market dominance.

Europe will contribute significantly to the growth of the market during the forecast period.

Europe’s contribution to enzyme market growth over the forecast period will be driven by its leadership in sustainable practices and technological innovation. In particular, the region’s focus on green chemistry and circular economy principles will drive demand for enzymes in various sectors. For example, in the detergent industry, European regulations promoting phosphate-free products have led to increased adoption of enzyme-based detergents, which offer superior stain removal without harming the environment. Additionally, Europe’s strong emphasis on biofuels and renewable energy sources will drive the use of enzymes in biomass conversion and biofuel production processes.

Collaborations between European enzyme producers and research institutions, such as EU-funded projects promoting enzyme discovery and optimization, will further accelerate market growth by facilitating the development of new enzyme solutions tailored to specific industrial needs. According to CORDIS – EU research results, starting in December 2023, the EU-funded FuturEnzyme project aims to develop low-cost enzymes for environmentally friendly consumer products such as textiles, detergents and cosmetics.

Through innovative solutions and collaborative efforts, it will receive approximately $6.71 billion for enzyme discovery and optimization by May 2025. Overall, Europe’s commitment to sustainability, together with its advanced research capabilities and supportive regulatory environment, positions it as a key driver of innovation and market expansion in the enzymes sector.

Main attributes:

| The report attribute | The details |

| No. of Pages | 412 |

| Forecast period | 2024 – 2029 |

| Estimated market value (USD) in 2024 | 14 billion dollars |

| Estimated market value (USD) by 2029 | 20.4 billion dollars |

| Compound Annual Growth Rate | 7.8% |

| Regions covered | global |

Premium Insights

- Advances in enzyme engineering and technological innovations to drive the market

- The US accounts for the largest share of the market in 2023

- China will hold the largest market share in Asia Pacific in 2024

- Carbohydrate segment to dominate the market during the forecast period

- Carbohydrate segment to dominate the market during the forecast period

- Industrial enzymes segment to lead the market during the forecast period

- Microorganisms segment to dominate the market during the forecast period

Case Study Analysis

- Process optimization in enzyme production

- The health company launched a new enzyme to help brewers in the production of beer

- Codexis Inc (USA) deployed its Codeevolver platform to develop a highly efficient and stereospecific ketoreductase enzyme

- International Flavors & Fragrances Inc. (US) launched a new enzyme for dairy products to reduce lactose levels and bring balanced sweetness

Market Dynamics

leader

- Growing environmental concerns and growing demand for biofuels

- Advances in Research and Development Activities for Technical Enzymes

- Shifting to Green Energy

- Multifunctionality of enzymes

Technology Analysis

- Correct fermentation

- Enzyme engineering

- Related technologies

- Solid state fermentation

RESTRICTIONS

- Strict regulatory framework

- The influence of environmental factors on enzyme structure and functions

- High cost incurred by SMEs in adapting to new technologies

OppORTuNiTy

- Demand for alternatives to synthetic chemicals

- Technological innovations and industry wide reach

- Emergence of encapsulation to increase enzyme lifetime

CHALLENGE

- High cost of raw materials

- Enzyme quality concerns in the food and beverage and food industries

- Lack of transparency in patent protection laws

Featured companies

- BASF SE

- International Flavors & Fragrances Inc.

- Associated British Foods PLC

- DSM-Firmenich

- Novozymes A/S

- Kerry Group PLC

- Dyadic International Inc.

- Advanced Enzyme Technologies

- Aumgene Biosciences

- Amano Enzyme Inc.

- F. Hoffmann-La Roche Ltd

- Codexis, Inc.

- Sanofi

- Merck KGaA

- Adysseus

- The Lesaffre Corporation

- Creative enzymes

- Enzymatic solution

- Enzymatic Deinking Technologies, LLC

- Tex Biosciences (P) Ltd.

- Denykem

- Metgen

- Biovet SA

- Biocatalysts

- Alltech

For more information about this report, visit https://www.researchandmarkets.com/r/lkl43t

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, leading companies, new products and the latest trends.

#Global #Enzymes #Microorganisms #Plants #Animals #Market #Forecast #Growing #Opportunities #Demand #Alternatives #Synthetic #Chemicals #Emergence #Encapsulation #Extend #Enzyme #Lifetime

Image Source : www.globenewswire.com