Let’s step back and ignore the last four years in which the economy crashed with the onset of the pandemic and then boomed from massive monetary and fiscal stimulus. Let’s also try to ignore the 6% peak in core PCE inflation in 2022 and the historically low 3.4% unemployment rate in 2023. What if in the years before the pandemic we told you that in 2024, the Fed Funds rate would be 5.25 -5.50%? You would probably have assumed that inflation was at least 5% and the unemployment rate was extremely low.

The current unemployment rate is 4%, and the core PCE inflation rate is 2.6%. In December 2019, the unemployment rate was 3.6%, and core PCE was 1.6%. At the time, Fed funds were 1.5%. Here we sit today, with the unemployment rate 0.4% higher and core PCE 1% higher than in 2019. However, the Fed Funds rate is 4% higher than in 2019. Does that seem a bit high? To help answer the question, consider the Fed’s long-term forecasts.

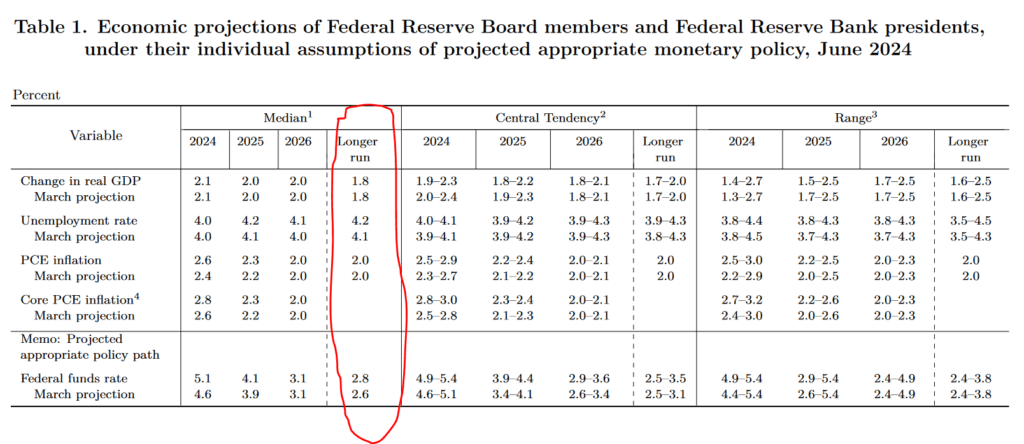

As we circle below, the Fed thinks the long-term natural rate of unemployment is 4.2% and the PCE is 2.0%. Under such a perspective, the Fed believes that the Fed funds rate should be 2.8%. While it’s hard to make a case for the Fed to cut rates today, a simple look at its two objectives, full employment and stable prices, and its long-term economic projections suggest that the current funds rate The Fed is extremely high. Even if the economy continues without a recession, it appears that barring higher inflation, significant rate cuts next year will be consistent with the Fed’s economic outlook.

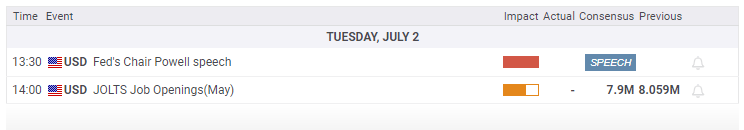

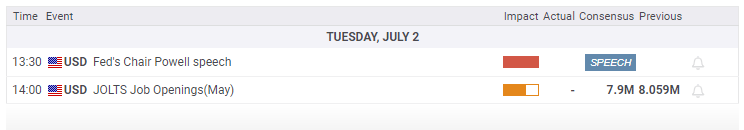

What to watch today

gains

- There are no notable earnings releases today

The economy

Market Trade Update

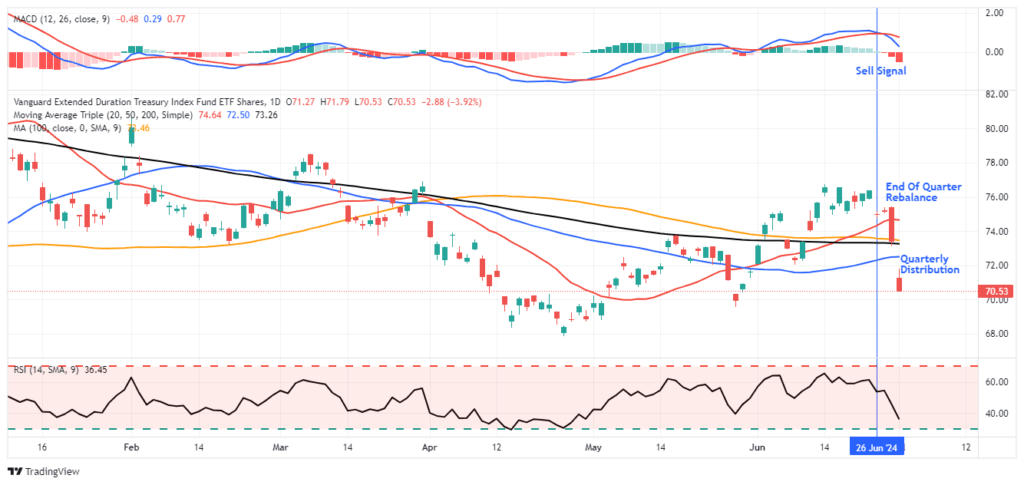

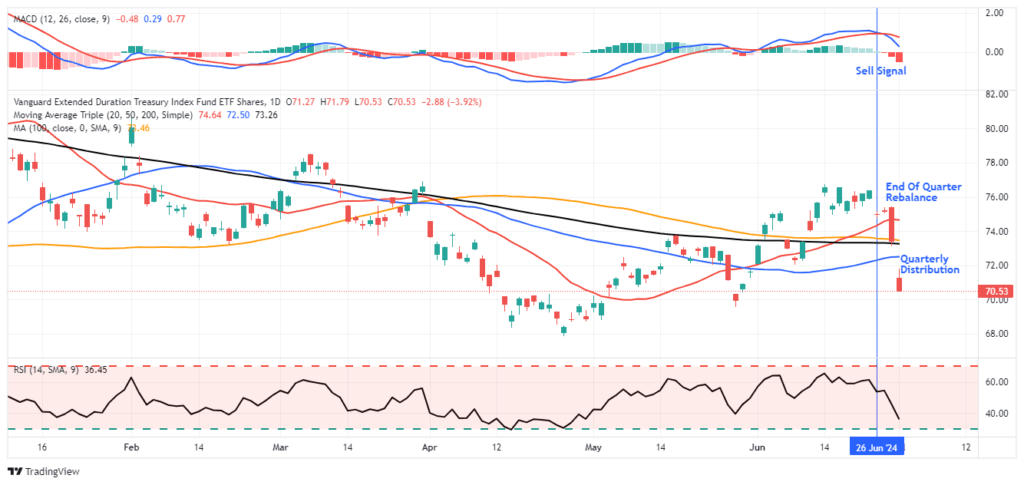

like discussed yesterday, this is the start of a new quarter, the end of the first half and the start of the second quarter earnings season. We noted that with this holiday-shortened week, volatility could certainly increase. Surprisingly, I received several emails about the sharp sell-off in long-dated Treasury bond ETFs. As shown, bond ETFs had a sharp reversal due to the quarter-end rebalancing and dividend distributions yesterday, temporarily depressing the price. However, bonds had enjoyed a very good rally and were overbought heading into the end of the quarter, so the sell-off is not surprising

Economic data continues to show economic deterioration, which supports bonds, so the recent selloff in bond ETFs is likely to present a good buying opportunity for traders. The last time bonds approached this level of oversold conditions was in April and May before a nice rally occurred.

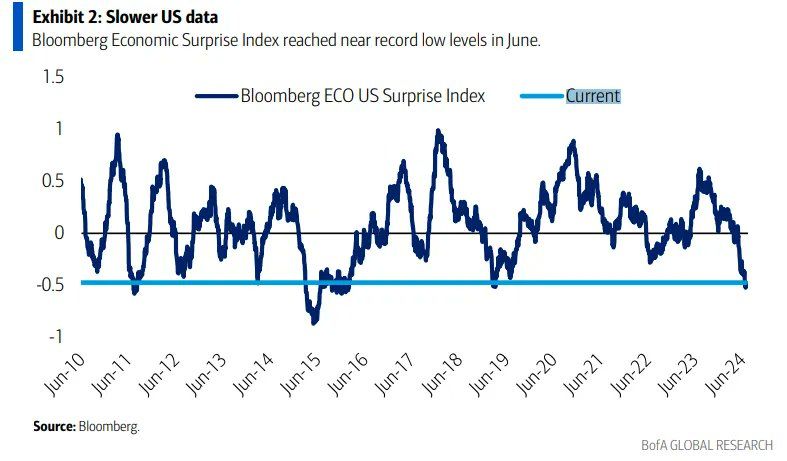

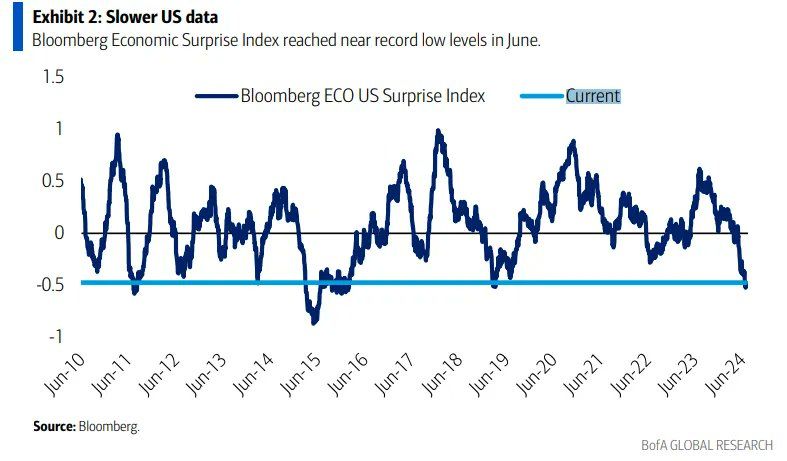

Index of Economic Surprises

We have read articles warning of an impending recession due to the low economic surprise index. While we don’t rule anything out, it’s best to evaluate what the index tells us. Surprise indices measure specific forecasts of economic data against actual data. When the surprise index falls, it simply means that economic forecasters are generally too optimistic. Therefore, the economic data is weaker than expected. Initially, this usually means that the economy is slowing down. However, economists are quick to adjust their forecasts for trend changes. Once that happens, the data can still get worse, but economists’ forecasts tend to be closer to reality or often overly pessimistic. Often, the surprise index will return. However, this does not mean that the economy is improving, it just means that the forecasts are more realistic.

As shown below, the surprise index tends to fluctuate. Low readings can precede a recession, but they happen with enough frequency that they often turn out to be a false alarm.

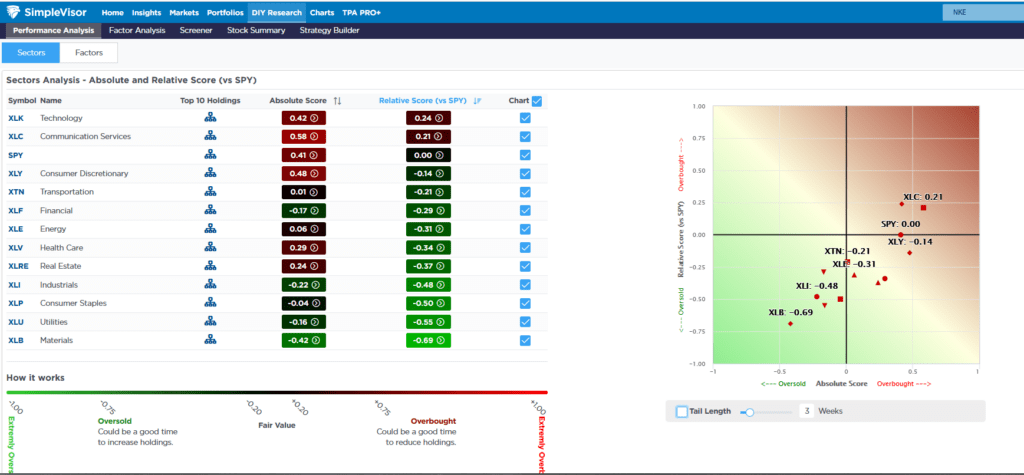

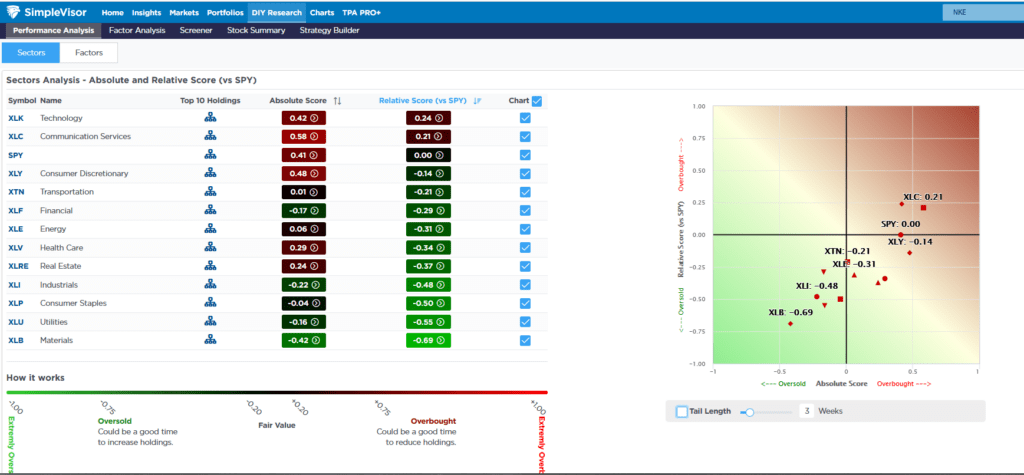

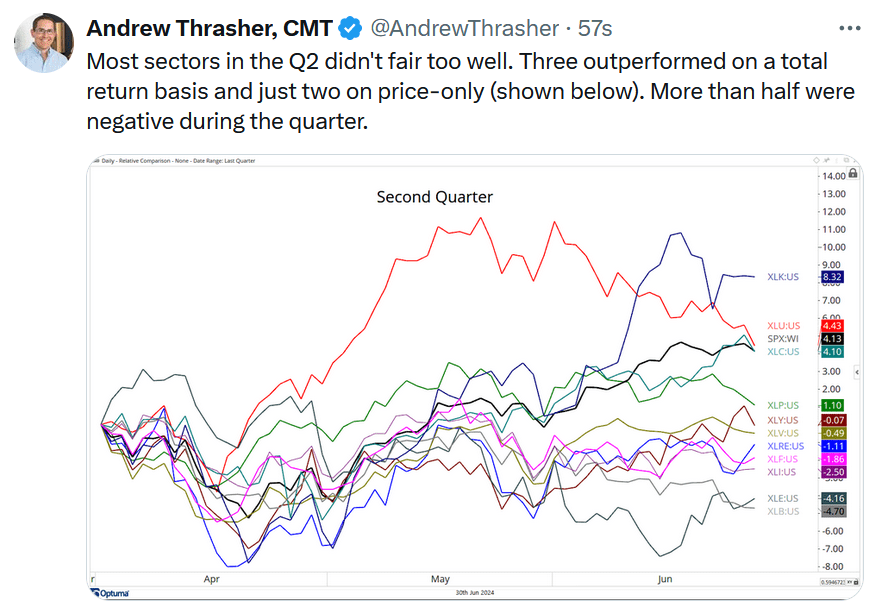

Sector Review- Materials Continue to Strive

Over the past four weeks, the materials sector ( XLB ) has fallen nearly 5% against the S&P 500. Aside from services, which are 6.5% worse than the S&P 500, it is the worst-performing sector over that period. Energy, which had the lowest relative SimpleVisor score for several weeks in a row, was the market’s best performing sector last week.

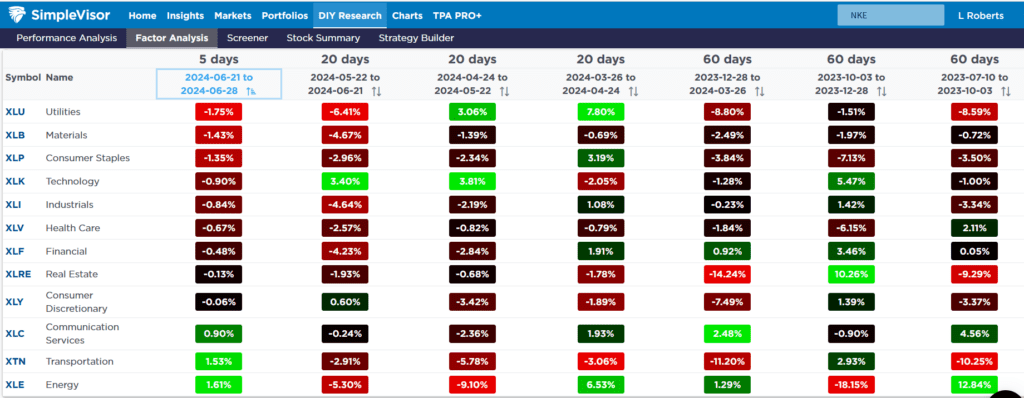

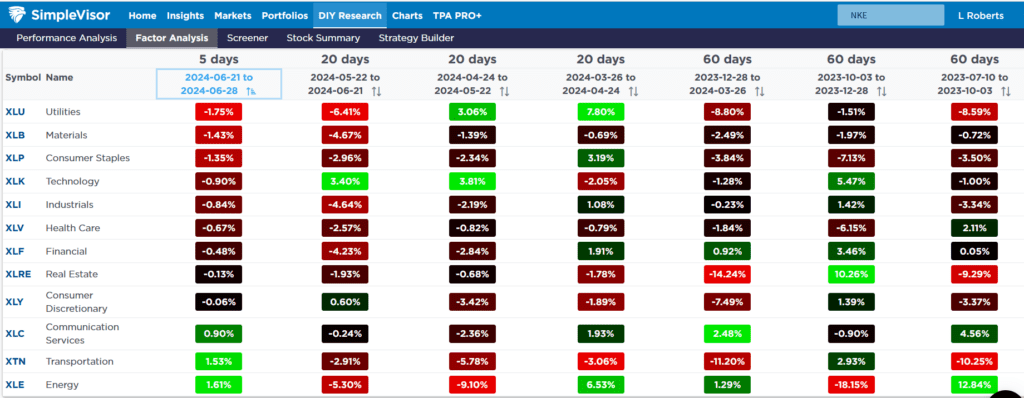

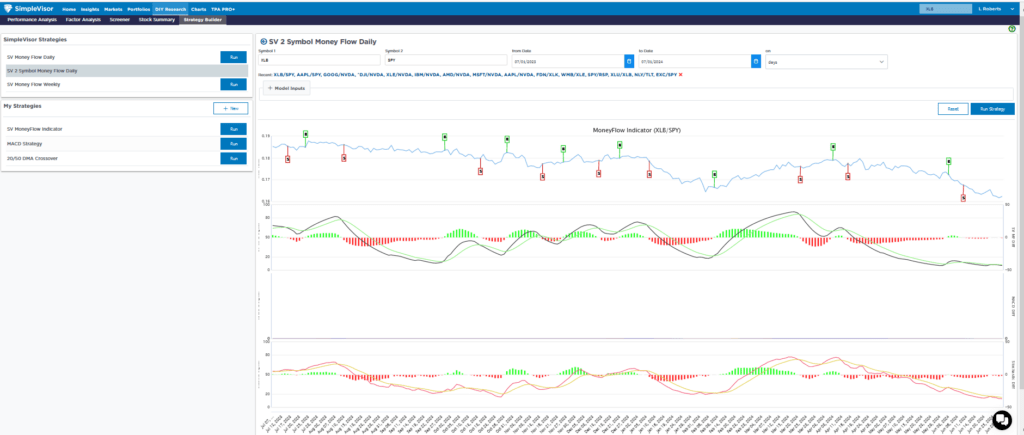

The second table, courtesy of SimpleVisor, shows the performance of each sector over successive periods ranging from the past five days to the 20- and 60-day increments.

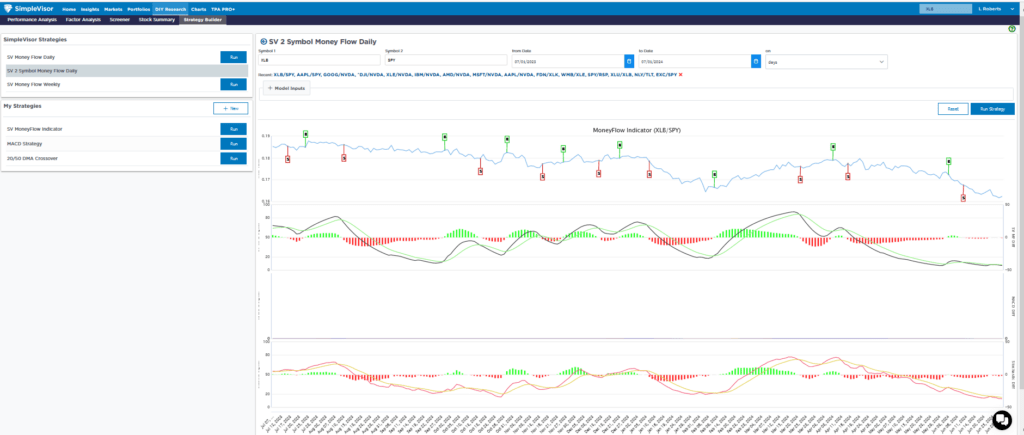

The third chart shows the price ratio of XLB to SPY. Apart from XLB’s outperformance in the first quarter of 2024, XLB has been weak on a relative basis.

Some may say that the weakness of material stocks is an indicator of the state of the economy. We would argue, claiming that the service sector accounts for three quarters of economic activity. The manufacturing sector has been in recession for about two years, but economic growth has been above average.

Tweet of the day

Want to achieve better long-term success in managing your portfolio? Here are our 15 trading rules for managing market risks.”

Please subscribe to the daily comment to receive these updates each morning before the opening bell.

If you found this blog useful, please send it to someone else, share it on social media or contact us to set up a meeting.

Post views: 958

2024/07/02

> Back to all posts

#Fed #funds #rate #high #RIA

Image Source : realinvestmentadvice.com