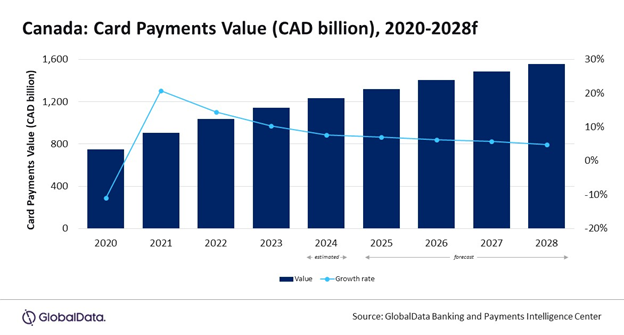

Canada’s card payments market is forecast to grow 7.7% in 2024 to reach CAD 1.2 trillion ($913 billion), driven by high consumer preference for electronic payments, according to publishers GlobalData.

GlobalData’s Payment Cards analysis reveals that the value of card payments in Canada recorded a growth of 14.4% in 2022, driven by an increase in consumer spending. However, the value registered a slightly slower growth of 10.4% in 2023 to reach CAD 1.1 trillion ($847.8 billion), due to the slowing economy.

Yasaswini Pujitha, Banking and Payments Analyst at GlobalData, commented: “The Canadian payment card market is mature with a high level of card adoption, developed payment infrastructure and merchant acceptance at the border. With an almost 100% banking population and a well-established framework for accepting multiple payment methods, making it one of the most advanced card markets both regionally and globally.

“The government’s reduction in merchant exchange fees, together with banks offering value-added services such as discounts and rewards on card payments, has further reduced consumers’ dependence on cash. The growing preference for contactless payments and growth in e-commerce are expected to further drive card payments.”

Credit cards and charge cards lead the Canadian payment card market

They account for 74.4% of total card payment value in 2024. Banks in the country are offering various value-added benefits to increase credit card usage, such as rewards, discounts and cashback.

Debit cards account for 25.6% of the total value of card payments in 2024. However, debit cards are most often used for everyday low-value payments, with the annual frequency of debit card payments in Canada standing at 221.3 transactions per card in 2024. , from 174.3 transactions per card in 2020. This is mainly due to wider merchant acceptance, convenience and security.

Access the most comprehensive company profiles on the market, powered by GlobalData. Save hours of research. Gain competitive advantage.

Company Profile – free sample

Thank you!

Your download email will arrive shortly

We are confident in the unique quality of our company profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the form below

From GlobalData

The interchange fee cap also encouraged merchants to accept card payments, thereby promoting the use of card transactions. The increase in debit card usage is supported by the marginal or no interchange fee associated with the Interac domestic debit card scheme.

In the case of credit cards, in July 2020 Visa lowered its credit card interchange fees to an average annual rate of 1.4%, from 1.5%. Mastercard made the same change in August 2020. Meanwhile, in December 2023, the Canadian government negotiated deals with Visa and Mastercard to lower interchange fees for small businesses. Credit card interchange fees for in-store transactions will be capped at an average of 0.95%.

Businesses with an annual Visa turnover of less than CAD 300,000 ($222,305.5) will qualify for lower interchange fees, while those with Mastercard annual turnover below CAD 175,000 ($129,678.2) will qualify for higher fees low from Mastercard. The new tariffs will come into effect in Q3 2024.

Growing contactless card adoption has also been a major driver of card-based payments, especially for everyday low-value transactions. According to Payments Canada’s 2023 Canadian Payment Methods and Trends Report, Canadians made 7.5 billion contactless transactions worth $379.7 billion ($281.4 billion) in 2022, up from 4.5 billion transactions worth $184 billion ($136.3 billion) ).

Pujitha concluded: “Although the economic slowdown continues to present some challenges in the short term, the Canadian card payments market is expected to continue its growth trajectory, registering a compound annual growth rate (CAGR) of 6.0% between 2024 and 2028 to reach CAD1.6 trillion ($1.2 trillion) in 2028, supported by high consumer preference for electronic payments, well-developed payment infrastructure and expected reduction in credit card interchange fees.”

#Canadas #payments #market #grow #GlobalData #predicts

Image Source : www.electronicpaymentsinternational.com